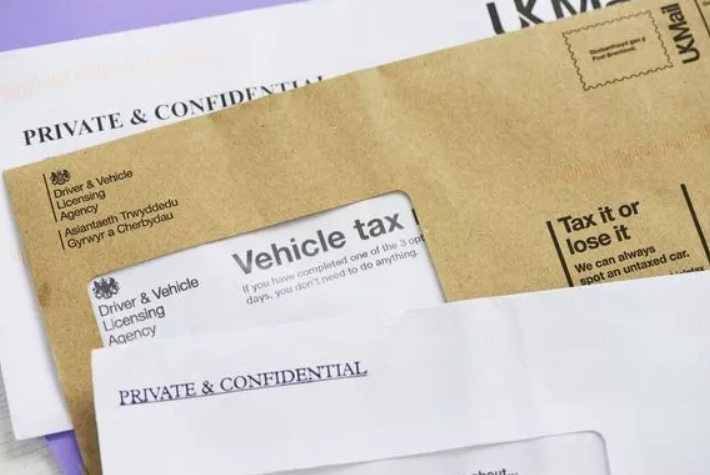

Car ownership comes with various responsibilities, and one of them is paying the Vehicle Excise Duty (VED), commonly known as car tax or road tax. This tax is collected and enforced by the DVLA.

Who has to pay car tax?

VED applies to most vehicles driven or parked on public roads in the UK. There are certain exemptions depending on the vehicle’s age, type and what it is used for. The registered keeper, named in the vehicle’s logbook (V5C), is responsible for paying the car tax.

Car tax must be paid regardless of whether you own the vehicle outright, finance it or lease it. For car leasing in Bristol, visit a specialist such as www.autolyne.co.uk/car-leasing-near-me/bristol.

How is car tax calculated?

The amount of car tax is determined by various factors, including the type of vehicle, its emissions, and the fuel it uses.

For cars registered after March 1, 2001, the tax is primarily based on the vehicle’s carbon dioxide emissions. Vehicles emitting higher levels of carbon dioxide generally fall into higher tax bands and pay a higher rate of VED. Electric and zero-emission vehicles are eligible for lower or zero-rated car tax as an incentive to promote greener choices.

Paying car tax

Vehicle owners can pay their car tax annually or monthly. The payment can be made online, by phone or by post with a debit or credit card or by direct debit. You can tax your car online here:

Failure to pay

The DVLA checks its database monthly to identify cars that are not taxed and haven’t been declared SORN (off the road).

If your car is flagged, you’ll be sent a warning letter. If you still fail to tax your car, you’ll be issued a fine of £80, which is reduced to £40 if you pay within 28 days. If you still don’t pay the fine, it could rise up to £1,000, plus court fees if the case is sent to court. If the police stop your car and you don’t have car tax, they can issue a £1000 Fixed Penalty Notice.